The mortgage industry is a key contributor to the US economy, and its impact can be felt across the country in tangible ways. It undertakes the sale, resale, and financing of thousands of new and existing homes and other properties every year, generating handsome revenue. Mortgage lenders engage in high-stake transactions that are decided upon after weighing in a lot of information. This process of evaluating the market value of a property is what mortgage appraisal comprises of. And to ensure that an appraisal is done right, mortgage appraisal services adhere to the current industry guidelines.

Why Do Properties Need to be Appraised?

An appraisal, in its essence, is an evaluation of a property that lenders need to analyze before investing in a mortgage. An appraisal is required for a fresh mortgage loan as well as a refinance mortgage loan. To ensure the accuracy of the appraisal, mortgage appraisal service providers enlist licensed or certified appraisers in the process. The accuracy of the appraisal is instrumental in aiding mortgage lenders to know precisely how much they should be investing in the property. Appraisals are designed to aid mortgage lenders in the following major ways:

- Confirm the True Value of the Property – Appraisals usually help ascertain the purchase price of a property. An accurate appraisal protects lenders from making investments that are likely to exceed the true value of a property.

- Gives Insights to Lenders – In this age where information is the most important currency, appraisals help mortgage lenders decide whether a property is worth investing in. A low appraisal leads to a slowdown of the mortgage process which is not desirable for those seeking to mortgage their property, but it gives lenders an edge in the negotiations.

Conventional vs FHA Appraisals

Standard or conventional appraisals are distinctly different from Federal Housing Administration mortgage loans. To understand the primary differences between the two, the following information is essential:

Conventional mortgage appraisal services in the USA comprise appraisals that are concerned with determining the market value of the property involved. This means assessing the condition of the property concerning its value.

On the flip side, during an FHA appraisal, two objectives must be met. The first is the same criteria for market value estimation. The other objective is the need for a property inspection that ensures that the property meets the minimum standards for health and safety as outlined by the Department of Housing and Urban Development.

What Does an Appraisal Aim to Determine?

In addition to determining the market value of a property, an appraisal also helps to determine whether the property meets the eligibility requirements to qualify for a mortgage. When government-backed mortgages such as FHA loans are opted for, the appraisal process helps lenders to determine the eligibility of the property for financing. These are crucial factors that mortgage appraisal service providers look out for before moving ahead with a mortgage loan. The basic requirements for a property to qualify for FHA loans include an assessment of the following:

- Estimating the Current Market Value of the Property – This is done to ensure that the property is truly worth the amount it is being mortgaged for.

- Assessment of Physical Attributes – Documentation of the condition of the property should capture the relevant details in a valuation conditions form, enlisting if there are any defects or damages that the lender should be apprised of.

- Physical Hazards – Ascertaining if any physical hazards may affect the valuation of the property.

- Longevity – The expected duration of the mortgage period must take into account an estimation of the longevity of the property.

Fundamentals of the Mortgage Appraisal Process

The most common approach that appraisers employ in evaluating properties is the comparable appraisal approach. This approach is based on similar properties to the subject within a specific distance. Properties with comparable size, layout, dimensions, and amenities fall within the scope of the comparable approach appraisal model. The comparable properties are those that already have recorded transactions instead of simply being listed. The overall process carried out by mortgage appraisal services comprises the following:

- Basic Information -The appraisal process starts with gathering basic information regarding the property, including the dimensions, structure, layout, etc. Equipped with this, the appraiser combines factors such as the age and condition of the property to arrive at a rough estimation for the mortgage value.

- Appraisal Inspection – This part of the appraisal process is meant for reviewing the internal as well as the external condition of the property. This is done to evaluate the structural integrity and shape to ascertain if there are any safety concerns to be wary of. The process also takes note of any new upgrades that may have been added to the property since its most recent transaction. Documenting these aspects of the property requires in-person visitations with appropriate images to support the findings. In certain cases, when the mortgage loan is being provided by government-backed schemes, an extra measure of checking the functionality of the utilities becomes part of the appraisal process. The conventional appraisal process has undergone several changes since the pandemic, and alternative appraisal methods have been explored that involve an external inspection combined with supporting images of the interior of the property involved.

- Research -Another critical aspect that appraisal determines is the current price of comparable properties in the market. An important factor to be considered here is that properties in a similar price range are characterized by similar attributes in structure as well as locale. For access to information related to comparable properties, property record listings are referred to.

- Valuation – Based on the information gathered by the appraiser after inspections and a comparative assessment, a valuation on the property can be arrived at. A comparison between the market value of the property with the appraised value helps lenders to make the right decision. If the appraised value is substantially lower than that of comparable properties or the current market value, lenders are made aware of the potential risks.

Understanding the Appraisal Report

A mortgage appraisal report concisely captures all relevant information that has led the appraiser to arrive at a final appraisal value. The report outlines the characteristics of the property, commenting on its features and background information on the current evaluation of similar listings in the market. All of this information contributes to the ultimate market value which the appraiser arrives at, and this value can be held relevant for a while, considering no sudden changes have impacted the mortgage economy.

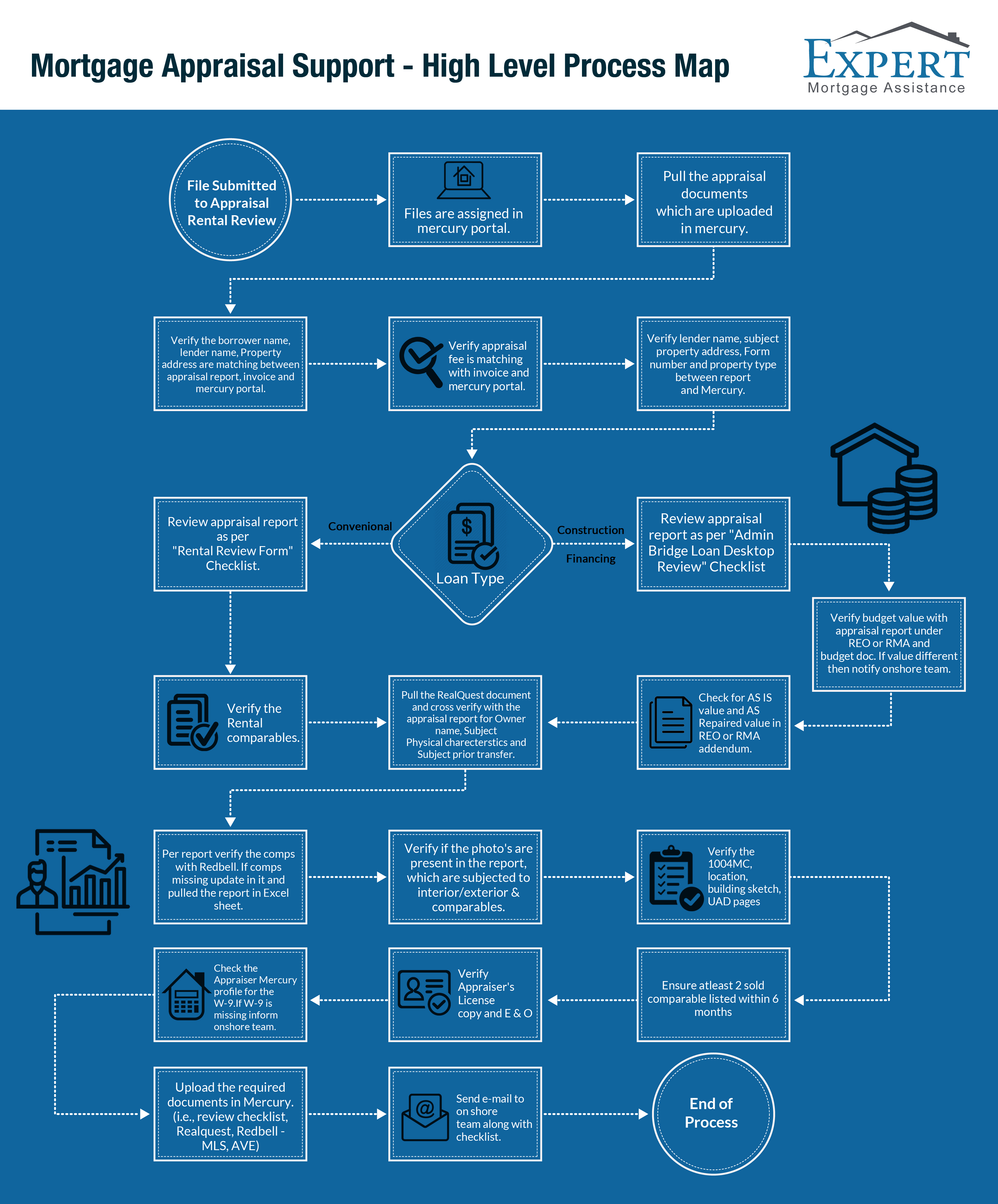

Mortgage Appraisal Review Process

Upon completion of the appraisal, the next step is for the lender’s review team to analyze the report and findings. An appraisal review underwriter takes on the task of scrutinizing and reviewing the appraisal report. In most cases, the appraisal is found to be free of errors and is accepted as is. But in certain cases where the appraisal estimates a lower value of the property than the expected value, a renegotiation becomes plausible. Mortgage lenders take into account the insights provided by the appraisal review to determine the value of the mortgage loan that is likely to provide ample returns. In certain rare cases, a second appraisal or field review may be required. Having a mortgage appraisal service on one’s side makes it much easier for lenders to navigate the legal jargon and make the right decisions quickly.

Assuring Compliance in the Mortgage Appraisal Process

Multiple changes and upgrades to the valuation compliance requirements make it challenging for lenders to keep pace with the appraisal process. But maintaining compliance is as important a part of the process as any. Non-compliance to regulations can slowdown the appraisal process, increase the cost of the overall mortgage processing, and might even lead to penalties or fines. The overwhelming amount of information that lenders need to be aware of makes it mighty important for them to have a mortgage appraisal service provider by their side. Some of the crucial ways in which mortgage appraisal services of the USA can contribute to the process are listed below:

- Knowing the Current Regulatory Rulebook – It’s difficult to stay on top of the exact regulations and guidelines governing mortgage appraisals. Lenders often go through the struggles of understanding what the jargon explicitly means. In some cases, even if the regulations are retracted, adherence to them remains difficult. Whether it’s the Home Valuation Code of Conduct or GSE Compliance Requirements, outsource mortgage appraisal services keep themselves up-to-date with the latest industrial practices to help lenders stay compliant.

- Manual vs Digital Appraisal Processing – The appraisal process is composed of intricate and lengthy procedures. The processing of such a complex matter ought to be handled in an efficient manner that smoothens the workflow. To this end, a manual appraisal system is not the most efficient choice. The difficulties of managing manual appraisals become all the more pronounced when there are multiple appraisals to process. Skilled mortgage appraisal services that possess tools of digitalization and automation are now considered essentials in the mortgage industry. They make appraisals easier to handle while maintaining compliance, saving time, and lowering costs.

- Valuation Technology – Gone are the days of calculating evaluations in error-prone manual ways. Modern valuation technologies are web-based and simple to use, but they guarantee error-free results. They also factor in configurable business rules which weigh in on churning out the right numbers. Web-based appraisal processes can keep complete track of the workflow steps, a necessity for compliance audits. Software solutions can also integrate various parts of the mortgage process to create a smooth workflow. All this and more can be easily brought on board with the services of a reputed outsource mortgage appraisal services provider.

- Unbiased Appraisal – One of the critical aspects of appraisal compliance is ensuring that the appraiser is not biased in providing a judgment. An established process for reviewing the appraisal should be in place to ensure that the procedure remains free of bias. Appraisal review is an important and time-consuming job that demands a thorough understanding of the appraisal laws and compliance. A trusty mortgage appraisal service firm can provide valuable insights into the appraisal process and make a seemingly difficult process more manageable for lenders.

Mortgage Appraisal Support Services

As a player in the competitive mortgage market, it’s desirable that the turnaround time remains as small as possible. From scheduling of appraisal to reporting, every aspect of appraisal management can be deftly handled by the support services offered by mortgage appraisal companies. Some of the essential services that lenders should look for when selecting an appraisal partner are listed below:

- Appraisal Review – To ensure thoroughness, accuracy, and consistency of compliance, the mortgage appraisal service provider can function as a checkpoint for risk management. Potential issues with the mortgage can be prevented if the appraisal review is carried out diligently. This is the reason why lenders prefer mortgage appraisal services firms that provide assistance in the form of efficient appraisal review and verification.

- Broker Price Opinions – As appraisals help to confirm the valuation of properties, a reliable evaluation is critical for lenders to arrive at a decision. Also, for computing the liquidity value of properties, broker price opinions provide valuable insights.

- Comparative Market Analysis – When comparing properties with other similar properties, thorough market analysis helps to establish the expectations of the market. An insider’s knowledge of the active listings and ongoing transactions can provide lenders with meaningful insights before considering an investment.

Executing a mortgage appraisal successfully requires fine-tuned knowledge of the basic guidelines that ought to be followed as well as an awareness of the essential compliant attributes. A mortgage appraisal services provider that can offer this thoroughness in appraisals is precisely what lenders and appraisal companies need to gain an edge for themselves in the mortgage landscape.

Who We Are and What Makes Us a Leading Appraisal Partner?

As an experienced mortgage processing service, Expert Mortgage Assistance (EMA) offers end-to-end appraisal services to lenders and appraisal companies alike. We leverage cutting-edge technology for digitization and automation to ensure high-throughput and error-free services for our clients. Our expert team remains on its toes to keep up with the current versions of rules, regulations, and industry best practices that guarantee the accuracy of mortgage processing. With the aid of a robust appraisal review process, we make it possible for lenders and appraisal companies to receive credible market value opinions. Our comprehensive services ensure that the mortgage appraisal process is executed most efficiently to realize operational excellence and a high bottom line.