Seamless Mortgage Underwriting Process Support That’s Quick and Accurate

We bank on experience, expertise and high-end tech to deliver cost-effective and time-bound mortgage underwriting services

Our mortgage underwriting support services assist lenders, and credit unions speed up documentation verifications and loan closures.

With mortgage underwrites experienced in assisting lenders and credit unions for over a decade, we inculcate a thorough understanding of the financial credibility required by applicants. We offer mortgage contract underwriting services to ensure each loan meets the secondary market guidelines. We also assist in assessing payment history, debt-to-income ratios, loan-to-value ratios, and other variables to ensure the loan disbursal to any applicant is a good investment. Our end-to-end mortgage loan underwriting process leverages the proprietary automation tool MSuite, that has helped clients scale their operations by making discreet lending choices.

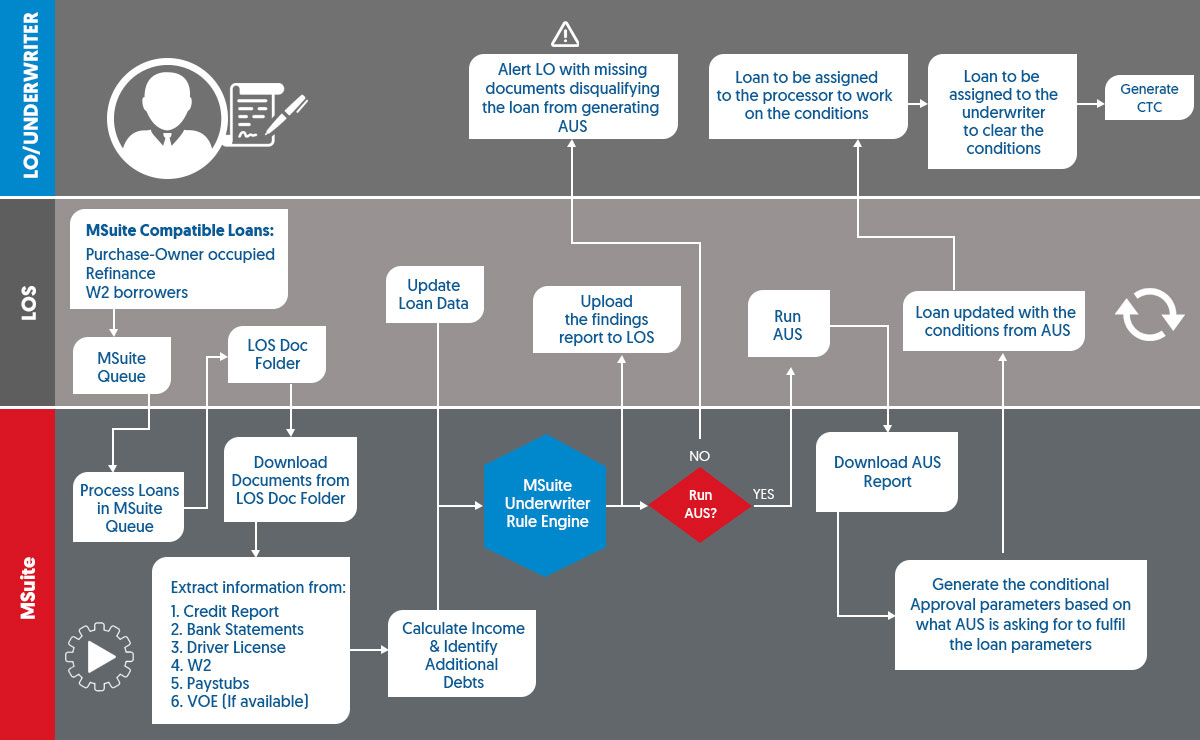

Simplifying Underwriting with MSuite

-

Get Started Now!

- Contact Us

- Chat

- Email Us

- Call

MSuite is a proprietary automation tool used to automate a number of mortgage processing requirements. The software can be plugged in as an indexing engine, data extraction tool, rules engine and reporting feature to improve turnaround and accuracy, scale operations and realize cost savings.

Msuite has capabilities to enhance upfront underwriting of files with salaried borrowers. The tool can manage thousands of rules and records simultaneously while being customization-friendly to cover only lender-specific rules. As a rule engine, the MSuite simplifies rigorous and complicated tasks like income calculations, asset reviews, 1003 reviews, credit/debit reviews, updated income calculations, asset liabilities, and finding reports.

As a tech-agnostic mortgage underwriting company, we use MSuite to automate underwriting process flows, and

- The automation tool alerts loan officers on any missing document. This leads to an automation disqualification of applications.

- Generates all the conditional approval parameters based on what AUS requirements.

- Loans are automatically assigned to underwriters to clear loans based on generated approval parameters.

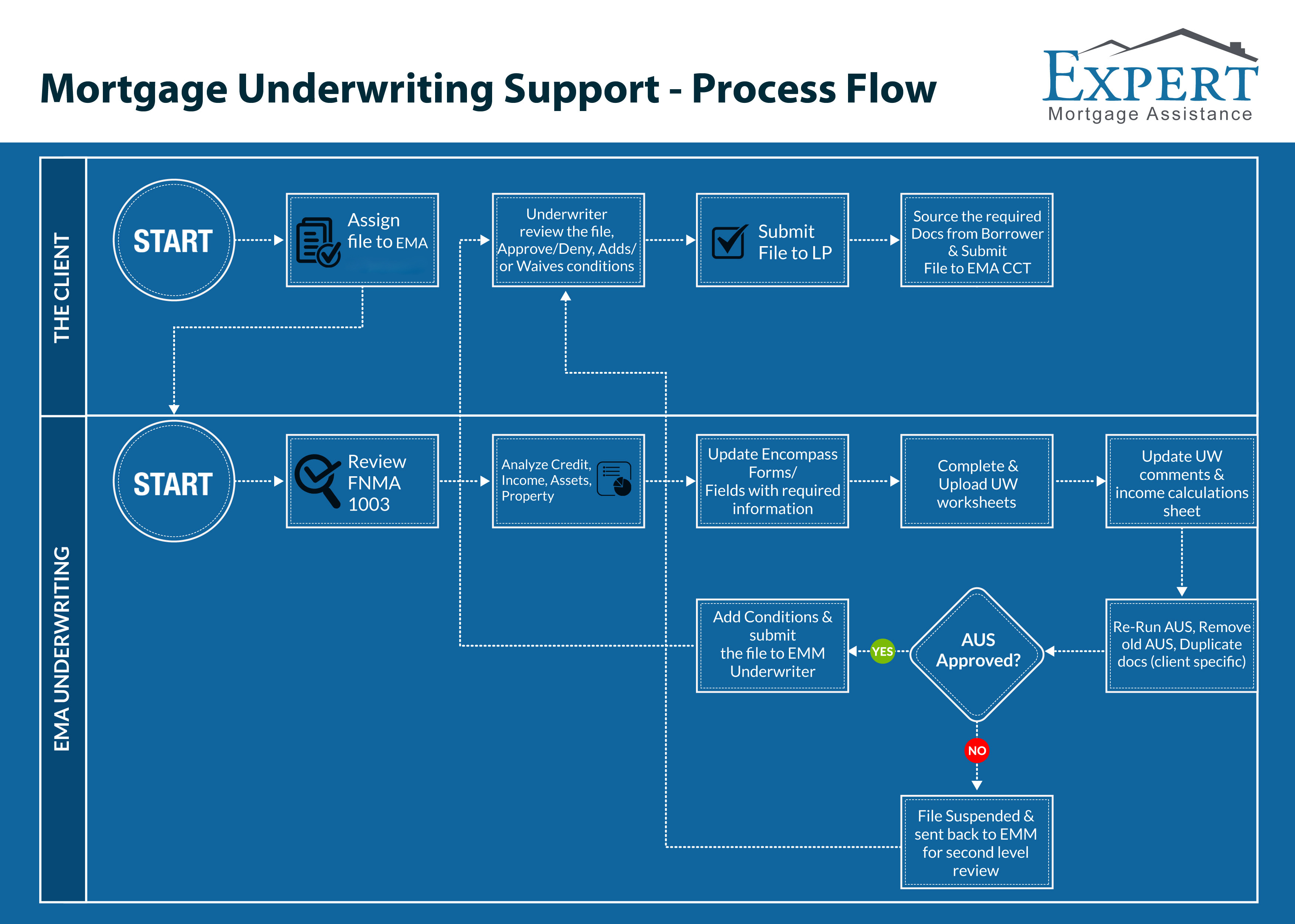

Process Flow for Mortgage Underwriting Support

Our Comprehensive Mortgage Underwriting Process Reinvents the Way You Work

Our underwriting support services are bolstered by industrious expertise in back-office support for the following requirements:

Running Automated Underwriting Systems

To provide lenders with real-time underwriting choices regarding the customers, we use automated underwriting systems using our proprietary automation tool MSuite. We are experts in Freddie Mac's Automated Underwriting System (Desktop Underwriter) and Fannie Mae's Automated Underwriting System (Loan Prospector). Make the greatest investment in your business by choosing to outsource all your mortgage underwriting needs.

We adopted the best practice rule of placing notes in the LOS to support each resubmission. With accurate notes, we ensure easy processing of DU files.

Clearing Loan Conditions

We grant a "clear to close" or final approval only once all the requirements have been satisfied. The outsourced mortgage underwriting services will help you make lp you make accurate judgements about providing a loan to the ideal applicant.

Most loan delays are frequently caused by the highly demanding tasks and responsibilities involved. Over the years, our efficient mortgage processing support services have assisted our clients in obtaining timely information on requirements like employment verification, justification for employment gaps, justification for late payments, and evidence of money flowing into relevant bank accounts.

We provide letters, proof, and other pertinent documentation to support your business objectives by utilizing our industry-leading mortgage contract underwriting services. To expeditiously clear loan conditions, you can also outsource the following underwriting for mortgage processes to us.

- Obtaining a clear title policy

- Verifying insurance policy (flood, home owners etc)

- Verifying appraisal report

- Verification of employment or deposits (VOE or VOD)

- Project approval (condo units only)

-

Get Started Now!

- Contact Us

- Chat

- Email Us

- Call

Title Review

We assist lenders by looking over paperwork related to the transfer of property rights, looking over title report mistakes, and even closely scrutinizing closing documents. For several of our clients, our extensive experience in reviewing title reports has enabled us to find numerous flaws or "clouds" in the title. We have a track record of precision title review as a leading provider of mortgage contract underwriting services.

- Review title report for title transfer

- Review title report for tax information

- Review title reports for property details

- Review title reports for judgement details

- Review title insurance

Appraisal Review

Professionals who handle mortgage underwriting outsourcing at Expert Mortgage Assistance have in-depth knowledge of the appraisal procedure. To guarantee the accuracy of the evaluation process, they maintain active communication with the appraiser. We follow a well-defined mortgage appraisal review process and always use the most recent appraisal report form for the particular kind of asset.

We also help the lender by looking over the report to make sure it complies with legal criteria. Before sending the report to the lender, we evaluate the appraisal's photos, location maps, property sales history, suitability of the comparable, revisions, report date, appraiser's signature, and license number. The mortgage contract underwriting services by Mortgage Assistance are thus versatile and comprehensive. With our streamlined services we ensure lenders get their appraisal work done in a short turnaround and with greater accuracy.

Fraud Review

Despite their best efforts to protect their company from fraud, lenders fall victim to scams due to a pressing need to expand their operations. Lenders and credit unions may ultimately benefit from investing in an outsourced mortgage underwriting service. Skilled mortgage underwriting firms employ fraud specialists with a natural aptitude for recognizing phony applications.

We specialize in spotting potentially fraudulent elements such AVM comps that don't match the appraisal, contradicting addresses, sizable transfers or withdrawals, numerous cash transactions across various bank accounts, and other such murky situations that could be signs of fraud.

- Verifying borrower residential addresses

- Verifying contractual agreements for relevance

- Verifying 3rd party docs

- Verifying bank statements and credit reports

- Carrying out phone re-verification

Our support services for mortgage underwriting are based on fundamental underwriting safeguards. For instance, to ensure more accuracy, we validate and re-validate data entered into an automated underwriting system (AUS). We also have the appropriate checks and signoffs. Senior underwriters with over ten years of experience in complex underwriting standards sign off after repeated quality checks.

Our experience and knowledge in underwriting enable us to promptly identify controversial topics, ask the proper questions of your borrowers, and detect inconsistencies.

We rely on a thorough and well-documented approach to obtain data to back up dubious appraisals, making us distinguish ourselves as a choice mortgage loan underwriting business for leading mortgage providers and financial institutions.

Quality Is the Byword for Our Mortgage Underwriting Services

Complex underwriting and processing requests are made easier with our expertise in automation. By delivering the right insight into your processes, we help you leverage a global talent pool of highly skilled underwriters and supervisors to deliver the best output.

By outsourcing your core mortgage processes such as underwriting to us, you have made an investment that saves you valuable time and resources in the process. As the choice of leading mortgage providers across the states, entrusting us with your mortgage processes is both an investment in the future and in the vision of your company. That’s because everything we do at Expert Mortgage Assistance is made to serve you best, the way that your business requires.

What Did the Pandemic Reveal?

- Educate buyers about changes in the mortgage underwriting guidelines implemented by Freddie Mac and Fannie Mae. For instance, buyers can provide alternative documents instead of a 10-day preclosing employment verification.

- Proactively inform buyers about Freddie Mac and Fannie Mae-enforced alterations to property valuation guidelines. For instance, alternatives to physical visits by appraisers to inspect properties.

Why Choose Us When Outsourcing Mortgage Underwriting?

By outsourcing mortgage underwriting process to us, you get the following benefits:

- 1000+ highly trained underwriters and processors working fulltime

- Comprehensive support for underwriting back-office needs (Capacity, Credit, Collateral)

- Standardized and automated back office processes for mortgage underwriting support

- High quality assured through multi-tier quality check

- Expert group to deal with regulatory requirements

- Up to 30% reduction in TAT, leveraging 24/7 work environment

- Up to 40% reduction in per employee operational cost

- Flexibility to scale work up to 50% during peak times

- Seamless communication and highly transparent operations

- 100% data confidentiality and privacy

- Flexible staffing model

Are you trying to find a reputable provider of mortgage loan underwriting services?

Get Expert Mortgage Assistance to handle your loan underwriting requirements because you will benefit from a more precise and timely approach.

FAQs on Mortgage Underwriting Support Services

Mortgage underwriting is the process used by a lender uses to evaluate whether the risk of offering a mortgage loan to you is acceptable or not. It is a part of the mortgage origination process in which underwriters look at your income, credit history, debt, and other factors to determine if you are a good candidate for a mortgage loan or not. In this process your assets, payment history, debt-to-income ratio, loan-to-value ratio, and many other variables will be closely evaluated to assess whether the risk of lending you a mortgage loan would be a good investment.

We can start as early as within 2 weeks to initiate underwriting support requests.

Mortgage underwriting guidelines are the minimum criteria that need to be met in order to qualify for a home loan. These guidelines can increase as you progress on the risk spectrum. The basic underwriting guidelines are established by 2 mortgage financing giants, Fannie Mae and Freddie Mac. For the most part, they require that all prospective borrowers meet certain income requirements, assets, credit scores, debt-to-income ratios, work histories, and minimum down payments.

Because mortgage underwriting is a detailed process, it can usually take anything between few days to few weeks. The average time it takes to complete the underwriting process is 5 to 8 business days. The timelines vary because every borrower is different and the process too will differ accordingly. On a daily basis each of our employee can complete 2-3 full underwrites with 2 conditions clearing (if needed).

There are many issues that pop up during the underwriting process. These include improper information, omissions of critical details, income discrepancies, and tax document discrepancies. Other problems include employment issues, credit history issues, and funding issues. Home appraisals can also be a point of contention as different organizations may come up with different values. Finally, unexpected issues might arise in the form of complex asset arrangements and other grey areas. In these cases, underwriters may need to rely on their past experience and expertise to assess the risk and protect the lender from undue risk. In such cases, Letters of Explanation come in useful as underwriters can use them to understand your personal situation better and make a more informed application decision.

Mortgage underwriting is the process by which lenders measure the risk associated with a particular home loan and to what extent it complies with the lender’s minimum lending guidelines. Once an application is delivered to an underwriter, they usually evaluate some basic criteria to determine how risky a particular borrower is to lend to. Some such factors include the borrower’s collateral, capacity, character, and credit. Depending on how well these criteria are met, a lending decision can be made. Once the underwriter evaluates a borrower’s propensity to pay back their home loan, they come up with either of the 3 lending decisions: approved, approved with conditions, or denied. Once the lending decision is determined, the mortgage application moves to the next stage of the mortgage origination process.

Fannie Mae, or the Federal National Mortgage Association, guidelines are the minimum requirements you need to meet to take out a mortgage loan in the US housing market. Fannie Mae guidelines are important because they were developed to make the financing process less risky for both consumers and lenders. Fannie Mae buys individual mortgages from lenders, repackages them, and then sells them to investors in the secondary market. The corporation has different requirements for different loans. The minimum requirements may vary depending on whether the property is a multi-unit home, secondary home, or an investment property. Some Fannie Mae guidelines may include down payment requirements, credit score requirements, debt-to-income requirements, etc.

Fannie Mae allows for asset dissipation, or the ability of borrowers to finance a home based on the liquid assets they possess such as stocks, retirement accounts, or money in the bank. Asset dissipation is important for borrowers who do not have conventional income streams such as retirees or workers in the gig economy. Fannie Mae allows asset dissipation because it allows high net worth individuals to convert their portfolios into cash for mortgage payments, without needing to have a steady income stream.

We are an ISMS certified company. This means t our clients can trust us with their sensitive business data . Also, our detailed data security and backup policies ensure that our client’s intellectual property is protected at all times. Further, we use a systematic approach to maintain our client’s sensitive information as our IT systems and business processes conform to standard risk management protocols prescribed by the AIAO-BAR. Finally, we ensure that all data transfers are 128-bit encrypted to eliminate any chances of data breaches for complete data security.

You can reach an Expert Mortgage Assistance sales representative via email at info***@expertmortgageassistance.com or by phone at 1855 – 224 – 6855.

-

Get Started Now!

- Contact Us

- Chat

- Email Us

- Call

Other Mortgage Underwriting Services

Skilled underwriting support tailored for credit unions, including automated systems, loan processing, risk management, and title or appraisal reviews.

Accurate foreclosure services using advanced tools, covering pre-closure evaluations, attorney management, property assessments, contract negotiations, and remediation oversight.

Comprehensive short-sale support by certified experts, handling hardship proof collection, appraisals, title clearance, deficiency evaluations, and market analyses.

Expert loss mitigation services including short-sale and foreclosure management, borrower solicitation, custom loan modifications, and tailored financial solutions.

High-quality loan modification support, including document reviews, income underwriting, and seamless fulfillment of the modification process.

Cost-effective origination underwriting covering appraisals, settlements, quality assurance, and compliance to streamline the mortgage lifecycle.

Comprehensive modification underwriting services, including loan restructuring, term extensions, partial claims, principal reductions, and shared appreciation agreements.

End-to-end borrower solicitation services, identifying payment challenges, delinquency causes, and educating borrowers on foreclosure alternatives or payment resets.

Specialized underwriting for lenders, focusing on creditworthiness assessments, collateral evaluations, and detailed borrower credit history analysis.

Additional Services for Mortgage Underwriting

- Mortgage Underwriting QC Support

- Signing Support for Loss Mitigation

- Mortgage Foreclosure Title and Resolution Support

- Setting Up Loans for Underwriting

- Clearing Loan Conditions

-

Get Started Now!

- Contact Us

- Chat

- Email Us

- Call