Outsource Mortgage Appraisal Support Services

Our mortgage appraisal services are designed to spot every controversial property issue and bring it to the attention of the lender or appraisal company

Expert Mortgage Assistance (EMA) offers a full suite of residential, commercial, and specialized appraisal services to lenders, credit unions, and appraisal companies. We combine intelligent valuation technologies, relevant market-based data, and analytics with our domain expertise to provide a simplified and highly accurate and reliable property valuation service. Every mortgage appraisal is completed in keeping with the Dodd-Frank Act, Appraiser Independence Requirements, the Interagency Appraisal and Evaluation Guidelines, and the Federal Reserve Board Interim Final Rule.

Given the declining value of homes and the rising number of foreclosures and distressed sales, the importance of appraisal reports has grown significantly. Added to this is the need to conform to regulatory requirements, which requires that lenders and credit unions produce accurate loan appraisal reports. All this has made the need for quality and upright appraisal services paramount.

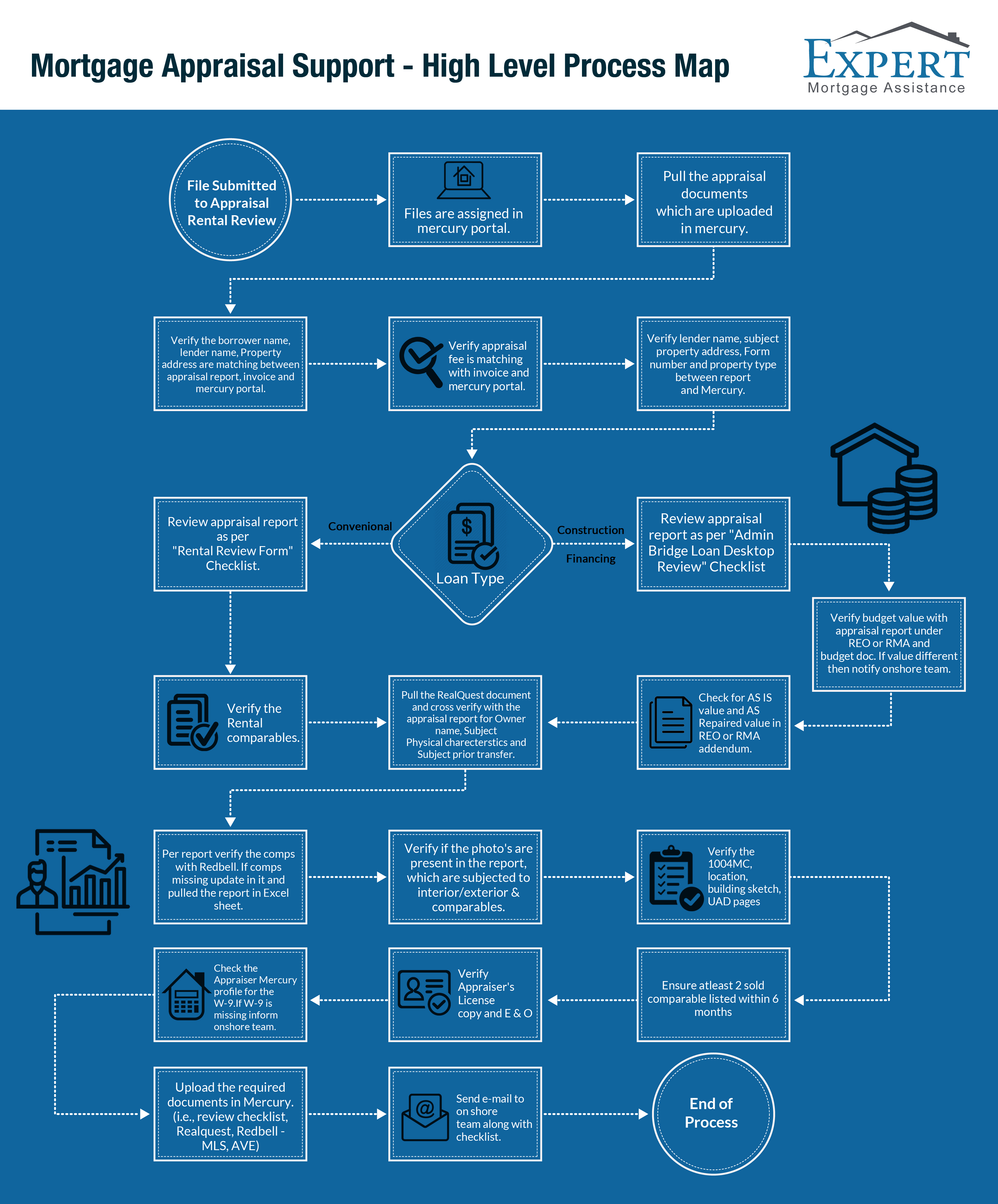

As a reputed mortgage appraisal support company, we leave no stones unturned to provide acceptable reports with credible property value. To ensure this at all costs, we have a robust appraisal review process in place, which reviews every report based on the key aspects of the appraisal process. The key aspects we watch for include location of the property, particularly those in declining markets, over-valuation of property value, inappropriate comparable sales, and non-traditional properties.

Quality Is the Byword for Our Mortgage Appraisal Process

We Offer A Range of Mortgage Appraisal Support Services

Our mortgage appraisal services USA consists of:

Appraisal Ordering

We order appraisals with the respective appraisers within a few minutes of the request being received from the lender or the mortgage appraisal support company. Our follow-up team works with appraisers to ensure every step of the mortgage appraisal process, like scheduling the appraisal, inspecting property, and reporting gets fulfilled in the least possible turnaround time.

We leverage advanced technology to order, monitor, and deliver every appraisal order. We have wide experience in initiating immediate assistance for all your loan appraisal needs. We also ensure our clients get real-time updates on their appraisal status.

- Order and follow up with AMCs/Independent Appraisers for timely receipt of appraisal reports

- Scheduling, inspecting properties, and reporting undertaken with the least turnaround time possible

- Order, monitor, and deliver appraisal orders with ease and efficiency

-

Get Started Now!

- Contact Us

- Chat

- Email Us

- Call

Appraisal Review

Once the report is received, we review it for thoroughness, consistency and compliance (USPAD & UAD). To put it succinctly, our mortgage appraisal service review is designed as a risk management tool. The review is done with utmost care, so that every potential issue with the property is spotted and brought to the attention of the lender. This ensures lenders get a clear and thoughtful analysis of the factors that impact the market value of the property.

During the mortgage appraisal process, we primarily look into the technical and logical aspect of the report. In the logical aspect, we try to understand the reasoning used by the appraiser to arrive at their final conclusion of value. It is at this stage that we bring our experience to the forefront. In the technical stage, we evaluate how the appraisal is put together and check if it meets regulatory guidelines along with Uniform Standards of Professional Appraisal Practice (USPAP) guidelines. All our mortgage appraisal review support services are performed by qualified and experienced appraisers, which takes away all your worries pertaining to accuracy and compliance.

- Review report for compliance, thoroughness, and consistency

- Review appraisal and identify any red flags based on agency guidelines and CU findings

- Provide lenders with a deep analysis of the factors impacting the market value of the property

- Submit detailed findings to lender’s in-house appraisal underwriters for FHA, VA, USDA, and Conv appraisals with the CU score of 4 or above

- Verify whether the reasoning behind the appraisal value is sound

- Verify whether appraisal meets USPAP guidelines

We review 15000+ appraisals on a monthly basis

(on behalf of Lenders and Appraisal Companies)

Broker Price Opinions

When lenders require a professional valuation of property, instead of a formal appraisal report, we help them with reliable Broker Price Opinions (BPO) to determine the general property value. Our BPO services include:

- Exterior inspection and description of the property’s condition

- Estimates of repairs to obtain fair market value

- Pictures of the property and street

- Estimated value based on normal and 30, 90, 120-day marketing times

- Current neighbourhood listings

- Location map

- Satellite map

Our broker price opinion is designed to help lenders or mortgage appraisal companies get accurate estimates for any of the following:

- Estimating the value before the property title exchanges hands

- Estimating the value of collateral for which the loan is sought, or while refinancing

- Computing property liquidation value

- Buying out a partner’s interest in a property, etc

We specialize in all the three primary methods used in the broker price opinion process to determine market value. These include the Sales Comparison Approach, Income Capitalization Approach, and Cost Approach.

Comparative Market Analysis

Our CMA services are accurately designed to help you determine the listing price for your home. Some of the services we provide:

- Exterior and interior inspection and description of the property

- Pictures of the property, street scene, and interior photos of all rooms and repair items

- Itemized list of repairs with cost to cure

- Estimated value based on normal and 30, 90, 120-day marketing times, "as is" and "as repaired"

- Homeowner Association details

- Active listings

- Listing of sold properties

- Location and satellite maps

Our approach to comparative market analysis is based on identifying the property to be sold or purchased with homes of similar size, age, condition, and style that have been recently sold in a certain neighbourhood. In case of non-availability of identical homes, we compare it with homes that closely match the home in question. This helps us determine a fair market analysis for a home.

While these services are the central component of our mortgage appraisal services, we also help mortgage appraisal companies register and manage appraisers.

- Comparative market analysis compares property to be sold with similar properties in the neighbourhood

- Comparative market analysis is not the same as an appraisal

-

Get Started Now!

- Contact Us

- Chat

- Email Us

- Call

Why Outsource Mortgage Appraisal Services to Expert Mortgage Assistance

Our clients outsource mortgage appraisal back-office services to us because we guarantee quality appraisal reports. We ensure our market value opinions are supported with strong judgements and deep analysis. We make sure that we do not miss out on all factors that impact the market value of a property and back our claims with the right documents.

Our mortgage appraisal services USA, helps you gain in the following ways:

- 1000+ highly trained mortgage processors working full-time

- 99% accuracy guaranteed in review of appraisal report

- Dependence on multiple resources to estimate value

- Flag and re-evaluate questionable appraisals

- Standardized and automated back-office support for appraisal review

- Up to 30% reduction in TAT, leveraging a 24/7 work environment

- Up to 40% reduction in per employee operational cost

- Flexibility to scale work up by 50% during peak times

- Seamless communication and highly transparent operations

- 100% data confidentiality and privacy

- Flexible staffing model

Fannie Mae Appraisal Forms / Reports

Our appraisal form filling and report generation is conducted strictly in keeping with the appraisal guidelines of Fannie Mae/HUD.

| Single Family Forms | |

| 1004 | Uniform Residential Appraisal Report |

| 2055 | Exterior-Only Drive-By Appraisal Report |

| 2075 | Property Inspection Report |

| 1004MC | Market Conditions Addendum to the Appraisal Report |

| 1004D | Appraisal Update and/or Completion Report |

| Condominium Forms | |

| 1073 | Individual Condominium Unit Appraisal Report |

| 1075 | Exterior-Only Drive-By Single Condominium Unit Appraisal |

| Manufactured Homes | |

| 1004C | Manufactured Home Appraisal Report |

| Investment Property Forms | |

| 1025 | Small Residential Income Property Appraisal Report |

| 216 | Operating Income Statement |

| 1007 | Single Family Comparable Rent Schedule |

| Cooperative Property Forms | |

| 2090 | Individual Cooperative Interest Appraisal Report |

| 2095 | Exterior-Only Inspection Individual Cooperative Interest Appraisal Report |

| Review Appraisals Forms | |

| 2000 | One-Unit Residential Appraisal Field Review Report |

| 2000A | Two-to Four-Unit Residential Appraisal Field Review Report |

Government Guidelines:

In strict keeping with the intent of federal, state, or GSE guidelines,our mortgage appraisal services are tailored to provide unbiased review with proper reporting mechanism.

Looking for a premier mortgage appraisal services company in USAto streamline your appraisal process? Outsource mortgage appraisal services to Expert Mortgage Assistance for unmatched excellence in appraisal management.

-

Get Started Now!

- Contact Us

- Chat

- Email Us

- Call